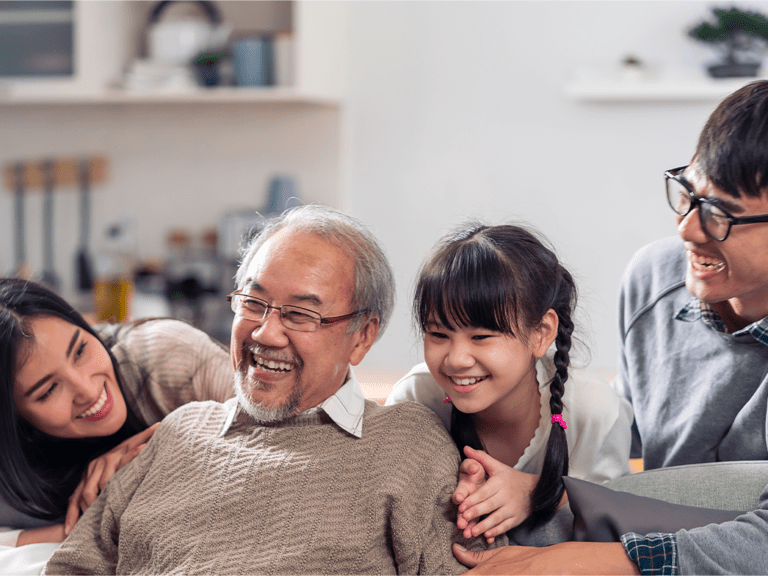

So, what is life insurance and how will it benefit you?

In short, Life insurance is an invaluable asset to protect yourself and your dependents from unexpected events such as the loss of income or death. It provides a comprehensive protection plan that not only covers immediate needs but also helps you achieve long-term financial goals to secure your family’s financial security while working towards achieving any future goals you may have.

Understanding Life Insurance

Life insurance is often overlooked because it is seen as “something for later” by most.

So, what is life insurance and how will it benefit you?

In short, Life insurance is an invaluable asset to protect yourself and your dependents from unexpected events such as the loss of income or death. It provides a comprehensive protection plan that not only covers immediate needs but also helps you achieve long-term financial goals to secure your family’s financial security while working towards achieving any future goals you may have.

How Does It Work?

A customer makes regular payments as premiums to an insurance company for their life insurance policy.

In exchange for these premiums, the policy can replace income or provide financial support for a customer’s dependents if the customer passes away prematurely. This helps the affected family cope with the sudden loss of income and eases their financial burden during a difficult time. When the insured survives the period of cover, the plan can provide a maturity benefit which can be used to meet longer term financial needs like children’s education or retirement.

What We Offer

Our products and services are designed to support your financial needs.

Be it life insurance to protect yourself for your loved ones, or a plan to secure your children’s future education or any other long-term financial needs, we want to help you achieve the peace of mind that you deserve.

Frequently Asked Questions?

Many situations can be unpredictable; you are never sure what life has in store for you. It is therefore important that you do not leave anything to chance, especially financial planning for your loved one. Life insurance is a tool to safeguard against financial hardship when an untoward incident occurs regardless of its death or disability or a major illness. It’s better to secure your life at the earliest.

Life insurance can be started from any age even as a child. Starting a life insurance plan early is always beneficial. Life’s uncertainty is applicable to all regardless of age.

Life insurance is an important way to ensure your family and dependents are not left with financial hardship when unexpected events occur to you whether its death or a disability or diagnosis of a major illness. It also provides peace of mind that any debts, including a mortgage, can be paid off and the education costs for children will be taken care of. Furthermore, life insurance helps maintain the standard of living enjoyed by your family even if something happens unexpectedly. Life Insurance also becomes a saving tool if nothing happens and becomes a wealth accumulation plan.

Life insurance offers numerous benefits that provide financial security and peace of mind for you and your loved ones. It protects one from life’s uncertainty and also acts as a savings tool at the same time, if the life insured is healthy and survives the insured period. Additionally, it provides income tax relief and serves as a financial guarantee.

According to the insurance policy, a formal legal guardian can purchase life insurance for those who are within the specified age limit for the purchase of life insurance.